Bitcoin Goldmine: A Deep Dive into AI-Driven Cryptocurrency Trading

The cryptocurrency market is unlike any other financial system in human history. It never sleeps, it never closes, and it is driven by a chaotic, 24/7/365 news cycle that spans the entire globe. For the individual investor, it presents both a generational opportunity and an overwhelming challenge.

How can a single person, with a job, a family, and a need for sleep, possibly keep up? How can they track technical indicators, global economic news, regulatory shifts, and the blockchain data itself, all while filtering out the social media "noise" that can send a token soaring or crashing in minutes?

For years, the answer was: they couldn't. Trading was an exhausting, high-stress activity dominated by two powerful, and often destructive, human emotions: fear and greed. The "panic sell" at the bottom of a dip and the "FOMO buy" at the peak of a hype cycle are all-too-common stories.

This is where a new generation of technology is fundamentally changing the game. Artificial intelligence (AI) and sophisticated automation are stepping in to do what no human can: process limitless data, identify complex patterns, and execute trades with cold, unemotional logic, 24 hours a day.

This article explores the rise of AI in crypto trading and takes a deep dive into platforms like Bitcoin Goldmine , which are designed to leverage this technology, offering a new, smarter way for both beginners and veterans to navigate the future of digital finance.

The Core Problem: Why Human Traders Are at a Disadvantage

To understand the solution, we must first appreciate the sheer scale of the problem. The challenges of manual crypto trading are immense.

-

The 24/7/365 Market

The stock market closes at 4:00 PM. Traders go home, analyze the day, and prepare for the morning bell. The crypto market has no bell. It is a relentless, continuous ocean of activity. A major regulatory announcement in Asia can cause a price collapse while European and American traders are fast asleep. This forces a terrible choice: either stay glued to a screen 24/7 (which is impossible) or accept that you will inevitably miss critical market-moving events.

-

Overwhelming Information Overload

What moves the price of Bitcoin? Everything.

Technical Analysis: Dozens of indicators across multiple timeframes (moving averages, RSI, MACD, Bollinger Bands).

On-Chain Data: Analyzing the public blockchain itself. Are large "whales" moving coins to exchanges to sell? Are miners holding or selling their rewards?

Global News: Interest rate decisions from the U.S. Federal Reserve, inflation reports from Europe, or new crypto-friendly laws in Japan.

Social Sentiment: A single tweet from an influential billionaire, a rumor on a message board, or a sudden wave of negative sentiment on X (formerly Twitter).

No human being can possibly absorb, analyze, and synthesize this volume of conflicting data in real-time to make an informed decision.

-

The Emotional Rollercoaster

We are not wired for trading. When we see a position rapidly losing money, our "fight or flight" instinct kicks in, screaming "Panic! Sell now!" When we see a coin "mooning" 100% in a day, our "fear of missing out" (FOMO) triggers, compelling us to "Buy! Get in before it's too late!"

These two emotions are the primary reason why so many retail traders buy high and sell low. A successful trading strategy requires rigid discipline, but discipline is the first casualty when your life savings are on the line.

How AI Is Changing the Trading Landscape

Artificial intelligence is the perfect solution to these human limitations. An AI-driven system is not a "crystal ball"—it cannot predict the future. Instead, it is a tool of unparalleled power for processing the present and acting on a logical, predefined strategy.

Key Advantages of AI in Trading

- Data Analysis at Scale: Where a human sees "noise," an AI sees data points. An advanced AI can scan millions of data points every second—news articles, social media posts, economic reports, and live blockchain data—to build a holistic view of the market.

- Unemotional, 24/7 Execution: An AI has no fear. It has no greed. It has no ego. It follows predefined rules without hesitation, protecting users from catastrophic losses and securing gains automatically.

- Sophisticated Pattern Recognition: AI models can find complex patterns in vast datasets—patterns that are completely invisible to the human eye, moving trading from "gut feeling" to statistics and probabilities.

A Closer Look at the Bitcoin Goldmine Platform

This brings us to platforms like Bitcoin Goldmine, which are built from the ground up to harness these AI capabilities and make them accessible to the average user. Instead of requiring you to be a programmer or a data scientist, it provides a user-friendly interface to leverage these powerful tools.

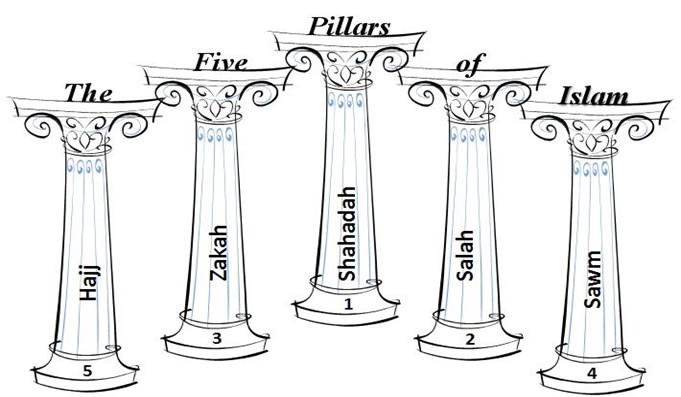

Based on our analysis, the platform's ecosystem is built on a few key pillars:

The Core AI Engine

The platform's primary feature is its advanced AI, which actively monitors blockchain data and market trends. It's designed to be a comprehensive portfolio manager that automatically analyzes opportunities for maximizing profits and minimizing risk. The system adjusts portfolios 24/7, rebalancing between assets like Bitcoin, Ethereum, and other promising altcoins based on real-time market analysis.

Marketplace for Automated Strategies

One of the most intimidating hurdles for new investors is not knowing what strategy to use. Bitcoin Goldmine addresses this with a "Marketplace" feature that allows users to find and activate trading bots created by experienced professional traders. This is a form of "copy trading" where you adopt an expert's entire automated strategy.

Accessibility and Ease of Use

The platform is entirely web-based, meaning there is nothing to download, install, or update. Users can securely access their dashboard and manage their portfolio from any device with a web browser—be it a desktop, tablet, or smartphone. This "trade-on-the-go" capability is essential for a market that never stops.

Risk-Free Demo Account

The inclusion of a free demo account is a critical, trust-building feature. It provides new users with virtual funds to test the platform's features, experiment with different automated strategies, and see how the AI responds to live market conditions—all without risking real capital. This allows users to build confidence before committing real money.

Who Are AI Trading Platforms Built For?

A common misconception is that automated platforms are only for high-end "quant" traders. The reality is that platforms like this are designed to serve a wide spectrum of users.

1. The Beginner

For someone brand new to cryptocurrency, the market is a terrifying wall of charts and jargon. An AI platform with a simple interface and a "copy trading" marketplace provides a guided on-ramp. It allows them to participate in the market without needing to become a full-time expert, relying on the automated strategies of seasoned professionals.

2. The Busy Professional

This user (a doctor, lawyer, or business owner) has the capital to invest but has zero time to watch charts. They cannot be bothered with 3 AM price alerts. For them, an AI platform is a "set it and monitor" solution. They can choose a strategy that aligns with their risk tolerance and let the automation work for them in the background.

3. The Experienced Trader

Even professional traders are human. They get tired, they make emotional mistakes, and they can't be at their desks 24/7. For them, the AI is the ultimate tool for execution. They can design their own complex strategies and use the platform's automation to execute them with perfect, unemotional discipline, ensuring their strategy runs flawlessly even when they are not.

A Realistic View: Risk and Reward

To be clear, no platform, no matter how advanced, can eliminate risk. The cryptocurrency market is, and will remain, highly volatile. Any investment can go down as well as up. In fact, most platforms in this space carry disclaimers noting that a high percentage of traders (often 70% or more) lose money.

It is crucial to understand that AI trading is not a "magic money machine" or a "get rich quick" scheme. It is a sophisticated tool for risk management and strategy optimization.

The goal is not to "win" every single trade. The goal is to use logic and probability to win more than you lose over the long term and to protect your capital from emotionally-driven disasters. Any reputable platform will encourage users to start small, use the demo account extensively, and never invest more than they can afford to lose.

Conclusion: The New Frontier of Smart Investing

The evolution of trading is clear. We have moved from reading stock tickers in the newspaper to real-time digital charts, and now, to fully automated, AI-driven analysis. The human element is shifting from being a frantic "button-pusher" to being a "strategist"—the one who sets the goals, defines the risk, and chooses the tools.

The 24/7, data-saturated crypto market is, in many ways, the first financial market built for AI. It's simply too big, too fast, and too complex for the human mind to handle alone.

Platforms like Bitcoin Goldmine represent this new frontier. By combining the processing power of artificial intelligence with a user-friendly interface, automated execution, and tools for both beginners and experts, they are providing a solution to the core problems that have plagued traders for years.

It's a smarter, more disciplined, and more logical approach to navigating one of the most exciting and volatile markets on Earth.